Judging by the headlines in the financial press, investors spent much of the past year anxiously awaiting one calamity after another that failed to occur. The plunge off the so-called fiscal cliff was averted. The euro zone did not fall apart. China’s economy and stock market did not crash. The bond market did not implode. The re-election of President Barack Obama did not derail the US market. The “flash glitch” in early August did not lead to further trading disruptions. Doomsday did not arrive on December 21, as some interpreters of the Mayan calendar suggested it would.

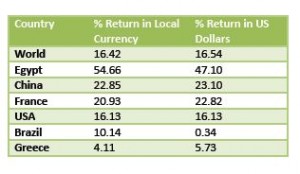

Instead, the belief that owning a share of the world’s businesses is a sensible idea appears to be alive and well, despite suggestions from some observers that the “cult of equity” is dead. For the year, total return was 16.42% for the MSCI World Index in local currency, and 16.00% for the S&P 500 Index. Among forty-five global stock markets tracked by MSCI, only three posted negative results in local currency (Chile, Israel, and Morocco), and twelve markets had total returns in excess of 25%, with Turkey leading the pack at 55.8%. Although much of the financial news over the past year highlighted Europe’s fragile financial health, most of the region’s equity markets outperformed the US, including Austria, Belgium, Denmark, France, Germany, the Netherlands, Sweden, and Switzerland. For US dollar-based investors, results were further enhanced by a modest decline in the US dollar relative to the euro, the Danish kroner, and the Swiss franc.

As is so often the case, earning the rewards offered by the world’s capital markets may have required a combination of discipline and

detachment that eluded many investors.

We wouldn’t say there is nothing to be concerned about. The fiscal negotiations balancing government spending and revenues are far from over and may well lead to bouts of flu like volatility this winter and beyond. What we would say is that all we know or think we know is reflected in current prices. We will respond as prices change without making the mistakes of acting on flawed predictions.

Without repeating all the details of forty five of the world’s global markets, here are a few highlights from 2012:

We are proud and excited by the progress made working with our clients over the years and will be sending our own highlights of ‘What’s New at Marin Financial Advisors’ shortly after this review. We would like to make you aware of the great tools and processes in place to help your financial experience be both productive and satisfying.