Did you know that Marin Financial Advisors is a leader in “Sustainable Investing”?

Over the years we have quietly evolved our investment philosophy and holdings so as to be able to focus our investment towards those companies doing the most good (and least harm) for the planet and for society.

In doing so, we have become leaders in this approach to incorporating environmental and socially responsible criteria into building client portfolios. In fact, MFA is one of the top investors in the sustainable funds of Dimensional Fund Advisors’ (“DFA”). Dave has served for over three years on the DFA Sustainable Council that has helped to shape the sustainable criteria to be applied by the fund. The council published a white paper on their work.

What is Sustainable Investing?

This type of investing also goes by names like “Socially Responsible Investing (SRI)” or “Environmental, Social and Governance (ESG)” investing.

The core principal is that in choosing which companies to hold in a portfolio, this approach not only considers the usual financial criteria, it also adds the additional layer of focusing more investment on companies that have demonstrated environmental responsibility while reducing or eliminating investments in those that haven’t.

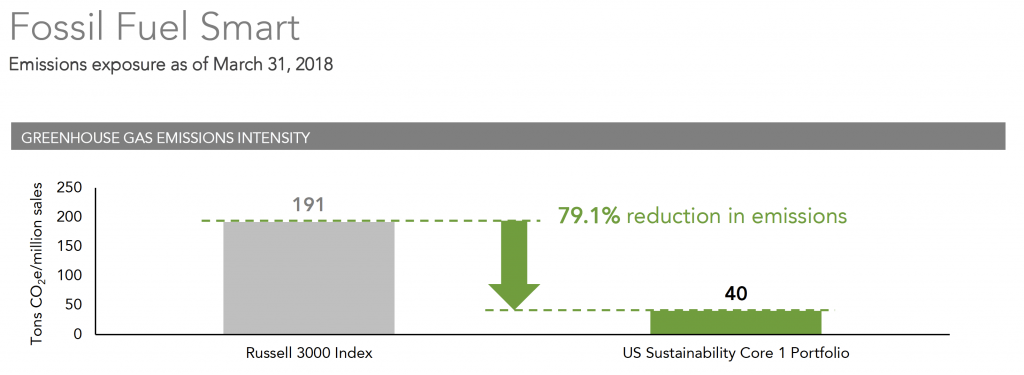

The focus here is especially on greenhouse gas emissions and their environmental damage. For example, the chart below shows that by applying the sustainability standards to their U.S. stock portfolio, the DFA U.S. Sustainable Core 1 Fund is able to hold a portfolio of companies with a 79.1% reduction in greenhouse gas emissions as compared to the whole U.S. stock market (Russell 3000 index)!

In addition to focusing on gas emissions, the fund also focuses on factors like land use, biodiversity, toxic spills, operational waste, water management, potential emissions from energy reserves, factory farming, weapons manufacturing, tobacco, and child labor.

At what cost?

There was a time when we felt that applying environmental and social criteria like this necessarily came with a tradeoff in cost, performance and diversification. That’s no longer the case. It’s now possible to apply both financial and environmental criteria without expecting to give up return or increase risk. In fact, by focusing where the economy is heading (towards more renewable sources of energy) rather than where it has been (e.g. oil, gas, coal), portfolios are arguably less exposed to the risk inherent in non-renewable energy sources.

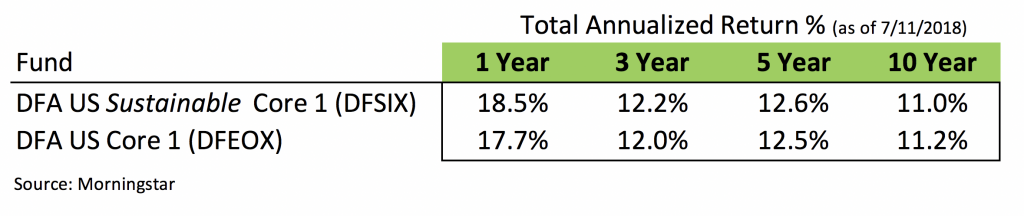

As shown below, the 1, 3, 5 and 10-year performance of the DFA U.S. Sustainable Core 1 fund virtually matches that of the regular DFA U.S. Core 1 fund:

Around the globe

We are now at the point where we can offer a sustainable investment solution not only for the U.S. stock portion of portfolios, but also for the International, the Emerging Markets and the Global Real Estate parts as well.

Moving forward

Client portfolios currently have varying degrees of holdings in the sustainable funds. Where we have the opportunity to use them, when it’s in line with your values and when tax considerations allow for it, we plan to increasingly use these funds.

Our core belief

It’s simply good business and it’s the right thing to do.

A long wait

While International and emerging market stocks were down for the quarter, U.S. stocks and global real estate were resilient and up about 4% and 6% respectively. These asset classes blended with bonds to leave most portfolios relatively flat for the quarter.

U.S. stock have yet to break past their January 26th high. This wait to recover from that early 2018 correction has already been the longest wait for a recovery in over a decade (recoveries on average take about 4 months). We remain patient and optimistic as general economic fundamentals remain very strong.

We’ll look forward to the opportunity to discuss this with you and we invite you to let us know when you’d like to come in and review things together.