It’s natural to question how the upcoming presidential election is likely to impact the economy and financial markets and to wonder how best to position your portfolio for the different potential outcomes.

Fortunately, much research on this question offers us the answer: Just stay the course – there is no reliably predictable winner or loser from the changing political landscape. And all landscapes have rewarded investors over time.

More specifically, election years have, on average, delivered positive returns in line with non-election years. The average return of the S&P 500 index during an election year since 1928 has been 11.3%. The average return in a year after an election has been 9.9%.1

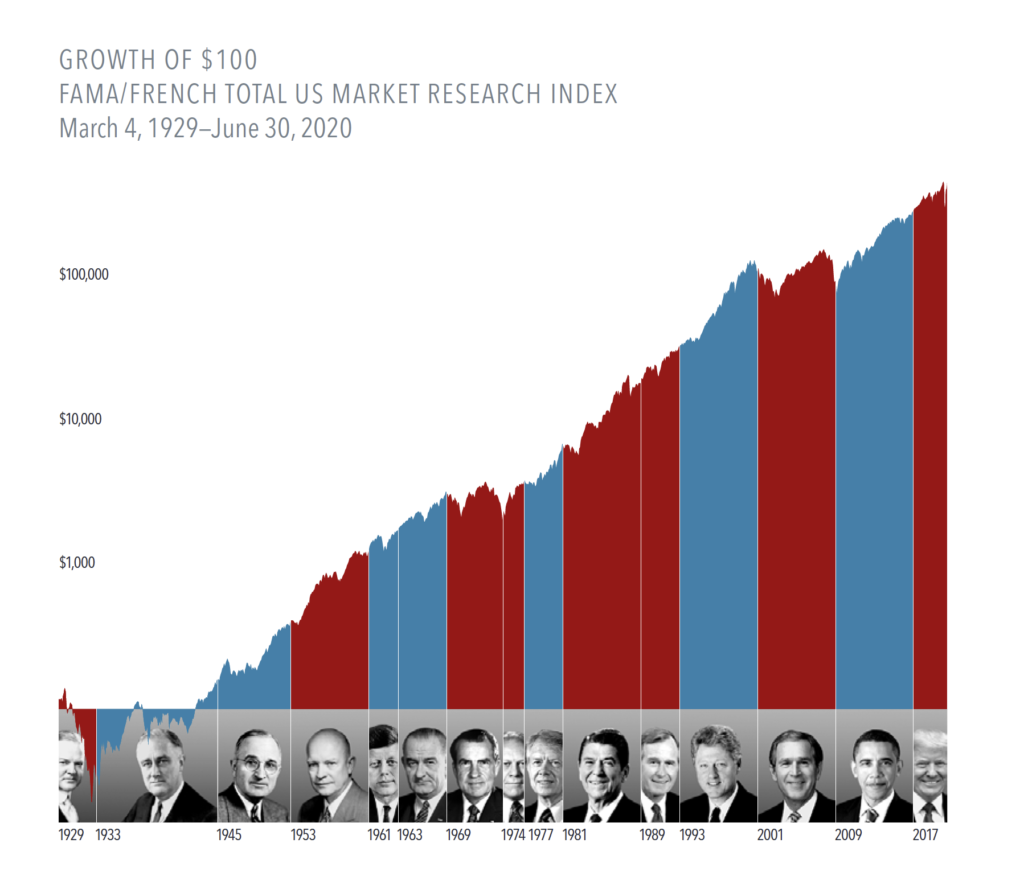

As you can see below, there isn’t an easy pattern to recognize in how stock market performance correlates with presidential party in power (besides generally being positive).

And, as you can see below, the markets have generally rewarded investors regardless of which party holds the white house:

The dips and surges in the markets have related much more to economic conditions than political ones. The bottom line is that the stock market tracks economic cycles much more than it does political environments.

Days prior to the 2016 election, we received two memorable calls: One client called certain that Trump would be elected and that markets would drop. Another called certain Clinton would win and that it would be positive for the markets. Each was 50% correct (Trump won and markets did great).

In simplistic terms, there are two possible election outcomes (Trump or Biden) and two possible market reactions (positive or negative). There is a 50/50 chance at getting either of those correct, which technically makes it a 25% chance of getting both correct. Thus, the odds of correctly making the right call about the actual outcome are low. And you don’t need to make a correct call to be successful.

Keep in mind that all day, every day, the markets are already factoring in the perceived likelihood that either candidate will be elected and the predicted impact that will have on the economy and markets. There’s no need (or reliable method) to outsmart the market.

We write this in the midst of the most challenging political, social, economic and health environment any of us has seen. We are well aware that we face a barrage of daily news which can be disheartening and leave us feeling a great deal of uncertainty. Markets are by their very nature self-correcting and adapt to the times as they unfold, growing with the economy over time.