If last January you were shown a crystal ball illustrating the global health pandemic and political turmoil that would unfold in 2020, you might just have thought it better to sit this one out of the markets. By the time March rolled around and delivered the fastest bear market in history with the S&P 500 index losing 34%, you might have felt validated. And then, you certainly could have felt confounded by the fastest rebound into a bull market in history. Finally, you may have been both delighted and surprised when the year ended up delivering perfectly healthy portfolio returns.

With all of its drama, 2020 managed to reinforce important lessons for investors:

Investing is about time, not timing.

The fundamental agreement an investor makes is that of being willing to accept volatility (discomfort) in the expectation of reward (return). Put another way, an investor experiences price volatility and fear of loss in exchange for the hope of gain.

Successful investing is about managing this balancing act between fear and hope.

That said, price volatility is not the same thing as risk. Risk is the possibility of not having money when you need it. We address that risk by working with you to have needed money secured in cash or bonds. Price volatility on assets you won’t need for years is not the same thing – it’s uncomfortable, but not necessarily risky.

In any given day, month or year, investment outcomes are uncertain – returns may end up being positive or negative. Over time, however, market averages reliably deliver positive returns. It really is a waiting game. And there is good reason to remain hopeful. The question is always when, not if, markets will recover.

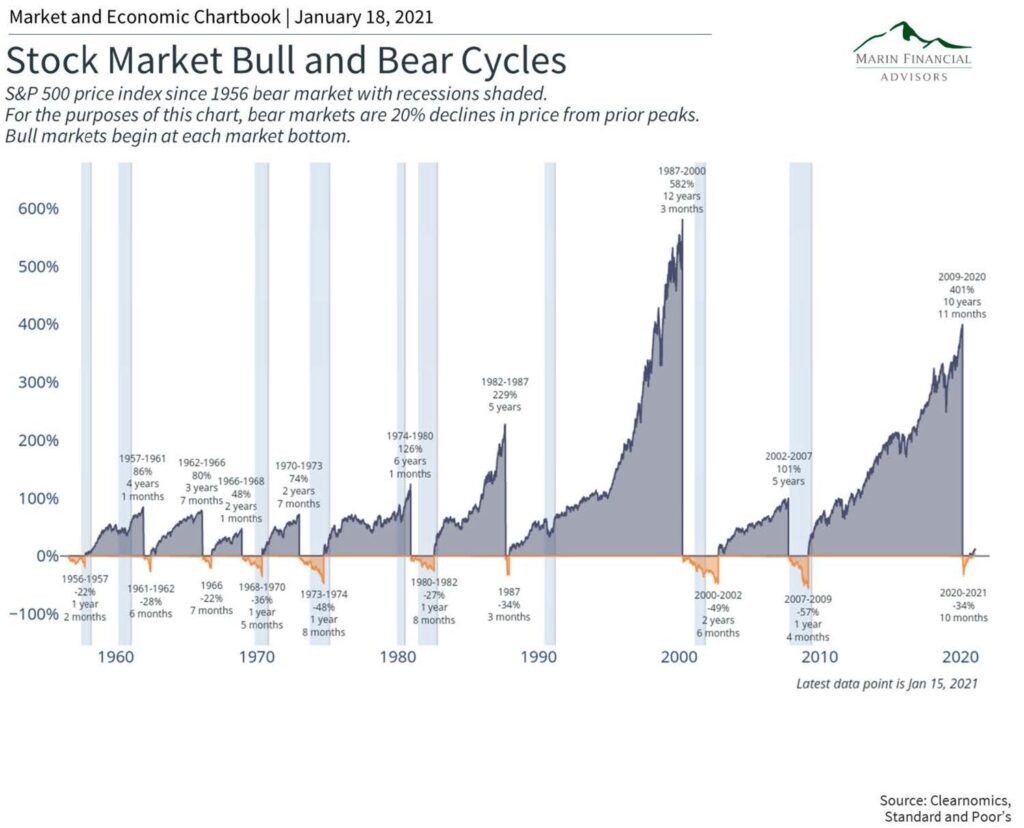

Take a look at this chart below. It illustrates all the “Bull” and “Bear” markets since 1956. Bear markets are defined as 20% declines. Bull markets are the runups that start from a bear market bottom.

Two things to notice: First, there has never been a bear market from which we didn’t recover. Second, notice that gains far outweigh losses.

The willingness to endure those negative (and scary) bear markets is the price of admission to the earning the rewards of those bull markets.

The odds of improving upon returns by skillfully timing into and out of the market are almost zero. The good news is that you don’t have to try. Your success doesn’t depend upon timing correctly.

Good investing isn’t about making great decisions – it’s about consistently avoiding mistakes.

Finally, risk is generally that which we don’t see coming: 9/11, the financial crisis or this pandemic. It’s very difficult to strategize for what you don’t see coming and what no one is talking about.

Broad diversification and time are still the most reliable approaches to successfully harvesting returns through unforeseen challenges.

And surprisingly, the investment game plan actually is to frequently lose money on the way to making money – that’s essentially what volatility is and what accepting it is all about.

2020 delivered a masterclass in these concepts in about as short a time as could be imagined. While many challenges remain ahead, we are pleased that 2020 delivered healthy returns.

We wish you a happy, safe and hopeful beginning to 2021.