Global stock markets continued their run of healthy returns to deliver a solid first quarter of 2021 with the U.S stock market up 6.4%, developed international markets up 4% and global real estate up 6.2%.

Notably, smaller value stocks, the kind we emphasize in our portfolio construction, have had an amazing resurgence, gaining 21% in the first quarter and whopping 97% over the last 12 months!

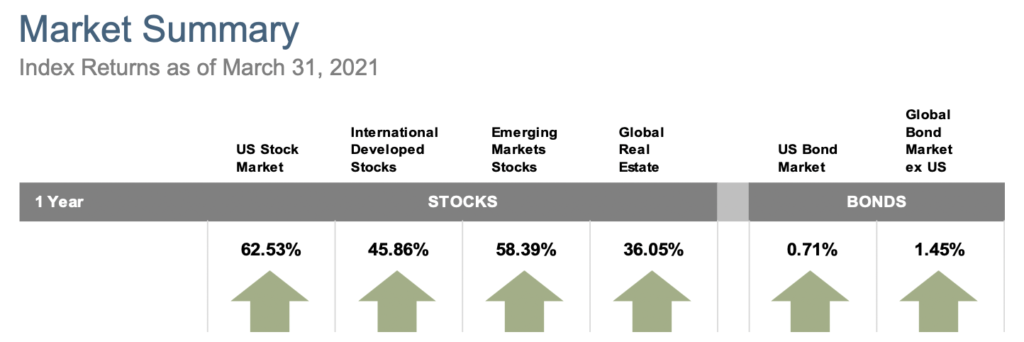

What is also remarkable is to look beyond the quarter to the last full 12 months through 3/31/2021 – stock market returns were extraordinary (See below).

This is partly because the 12-month returns start measuring from 4/1/2020 – just days after the bottom of the pandemic-related market drop last year and capture most of the full recovery. Nonetheless, this is an exceptional year for stocks.

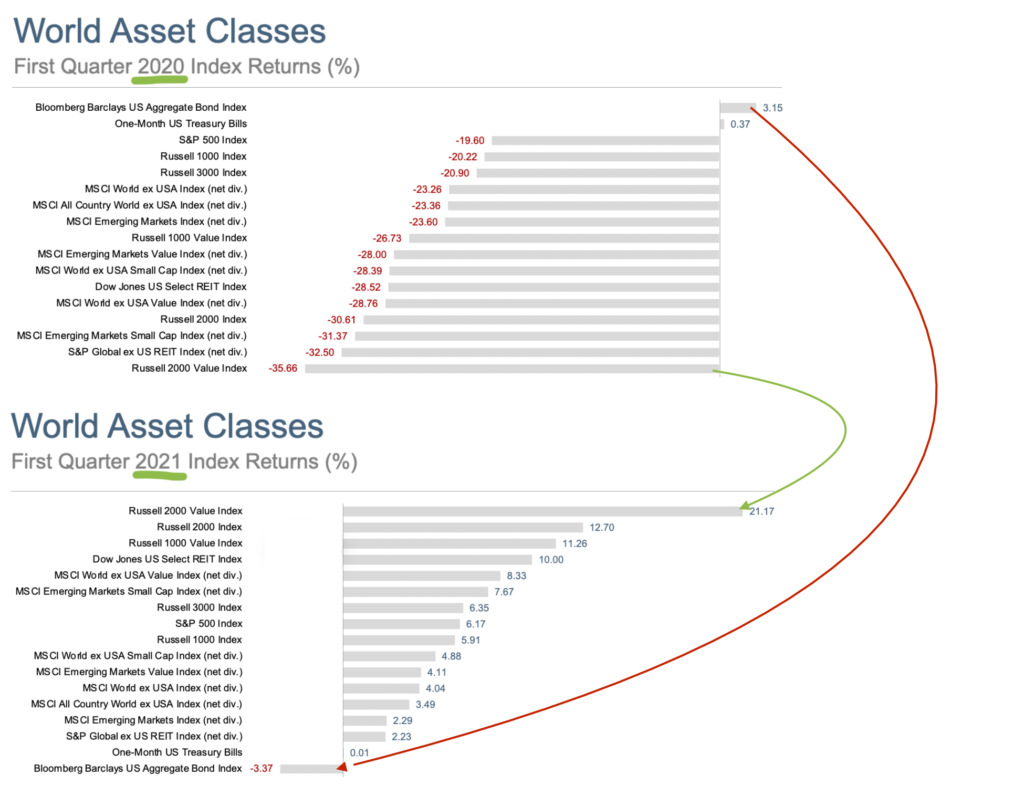

It’s also fascinating to dig a little deeper and compare how different parts of the market had performed during the first quarter of 2020 (in the thick of the pandemic fall) and see how they did over the first quarter of 2021.

Let’s take a look at the various parts of the global stock and bond markets. Q1 2020 ended with the Russell 2000 Value index (smaller and cheaper stocks) hit hardest while the Bloomberg Barclays US Aggregate Bond Index topped the charts (see the top graph below)1.

It may have been tempting to pull money from small value stocks and put it into bonds. But as the arrows on the graph above show, the Russell 2000 Value Index topped the charts this last quarter (and bonds fell to the bottom) – a complete reversal.

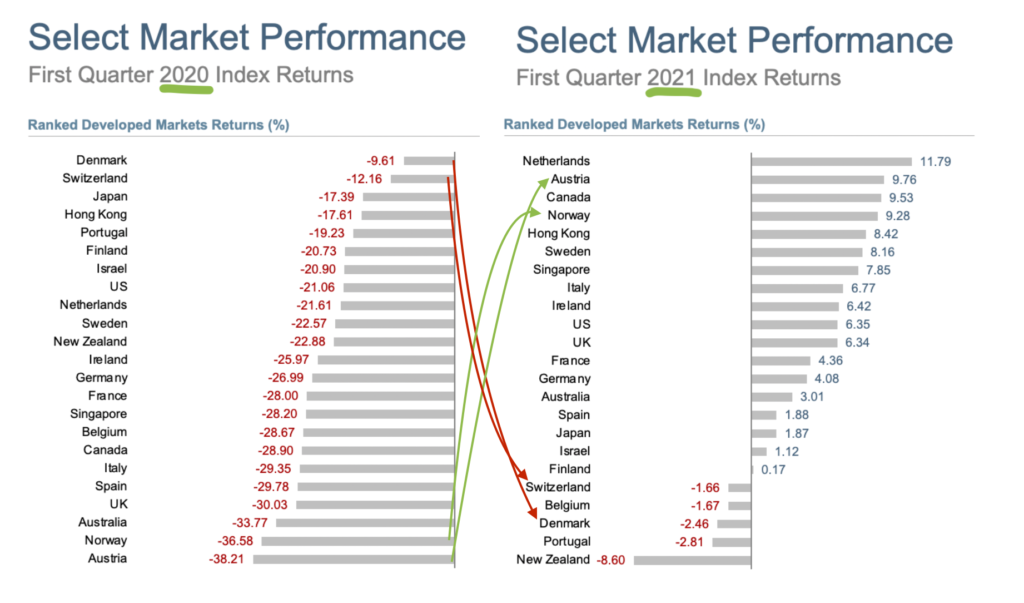

How about if we take a look at how various countries’ stock markets performed? It might have been tempting to favor Denmark and Switzerland over Norway and Austria after seeing Q1 2020 performance (left side below). Again, Q1 2021 delivered just about the opposite (right side below) 2.

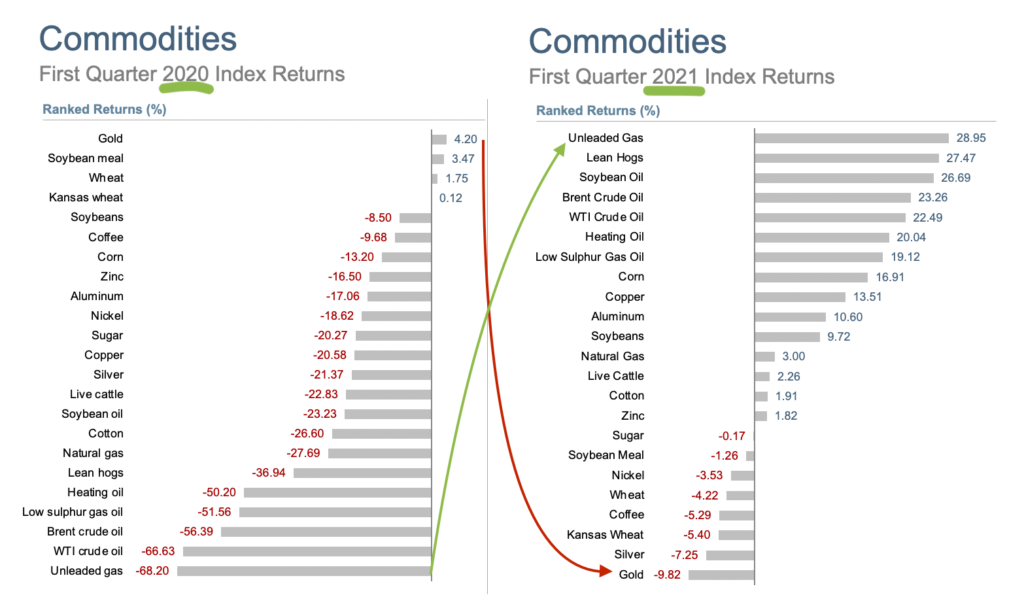

How about if we were looking at various commodities? At the end of Q1 2020, we may have tempted to fear Unleaded Gas and favor Gold. Once again, Q1 2021 delivered the exact opposite with gas soaring and gold sinking (Keep in mind we don’t invest directly in commodities – this is just to illustrate a point) 3.

What’s the moral of the story? Looking in the rearview mirror all the time is not only a dangerous way to drive, it’s a poor way to invest. Which asset classes and sectors lead in a given quarter or year is constantly shifting.

That’s why we maintain a broad and constant exposure to virtually all global stocks (and a broad selection of global bonds). We’ll endure the pullbacks (like Q1 2020) to enjoy the comebacks. And what an excellent comeback it has been.