You may have heard us profess that we don’t try to time markets because we believe it is extremely rare to find someone who has successfully done it over the long run. Well now there is more proof.

Getting out of the market at the top is one thing, getting back in is another.

Mark Hulbert has been tracking 160 financial newsletters since 1980 via his Hulbert Financial Digest. Mr. Hulbert recently wrote an article in the Wall Street Journal titled “Still Trying to Time the Stock Market? Read This First”1. In the article he cites the example of Richard Russell, the editor of the long running Dow Theory Letters newsletter. Mr. Russell accurately called the market top in 1987 prior to the worst one-day crash in US stock market history. What happened next is telling. Mr. Russell couldn’t muster the conviction to get back into the market. He is quoted in Mr. Hulbert’s article as recently saying “After a vicious bear market, there is a disposition in people’s minds to think current conditions will be permanent”. Mr. Russell finally gave the signal to buy in August 1989 at roughly the level he exited two years earlier. This confirms that the practice of market timing requires one to be right twice: when to get out and when to get back in.

Buy-and-hold may be boring but it works over time.

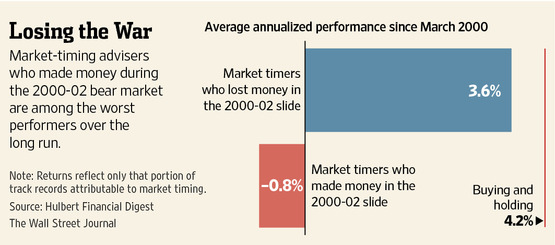

Mr. Hulbert conducted a study of 81 stock market timers over the last 15 years, a period which begins just before the bear market which started as the Internet bubble burst in March 2000. The study was broken into two groups: those timers who got out before the crash and those that didn’t. Interestingly, those newsletter writers who were prescient enough to advise their readers to get out of the market before the crash and made money during the downturn of 2000-02 underperformed over the long run versus those who missed it and lost money during the pullback. By the way, when both timing groups’ investment performance was compared to a simple strategy of holding the overall US stock market2 [buy and hold], neither timing group beat the 4.2% annualized return of being fully invested over the 15 years [see chart below].

Many times the hardest thing to do is not take action. We realize that some of the value we provide is acting as a sounding board and calming voice among all the noise and occasional turmoil. Please feel free to call and discuss with any of us.

1 The Wall Street Journal August 9-10, 2014 p. B7

2 The Wilshire 5000 Total Market Index