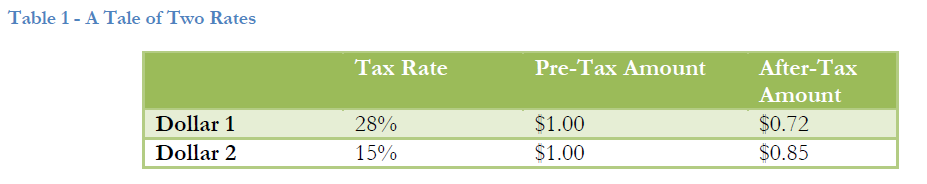

Imagine you can have one of two dollars. One is taxed at 28%, the other at 15%. One leaves you with 72 cents to spend, the other 85 cents. Which would you choose?

When we put it that simply, it seems pretty obvious to choose the lower tax rate and end up with more spending power. Yet this simple fact is widely overlooked by many investors seeking income. And there’s no better time to talk about this than the month in which personal tax returns are due.

For those seeking current income from their money, it is common to think of instruments that provide a yield, such as Bonds or Certificates of Deposit. Designed for stability of principal as well as current income, bonds and CDs get no love from the IRS. All interest is taxed at our highest “ordinary” rates. Real Estate Investment Trusts (REITs) also offer high yields but their attractive dividends are also taxed at our highest rates.

Dividends from common stocks, for the moment anyway, enjoy favored status from the IRS – they are taxed at just a 15% at the federal level, regardless of income. The same low rate applies to the dividends of mutual funds and ETFs that invest in common stock. At MFA we keep track of these differences and strive to put the investments taxed at higher rates into client retirement accounts where taxes are deferred.

Conclusion #1 – A dollar of dividends is more valuable than a dollar of interest.

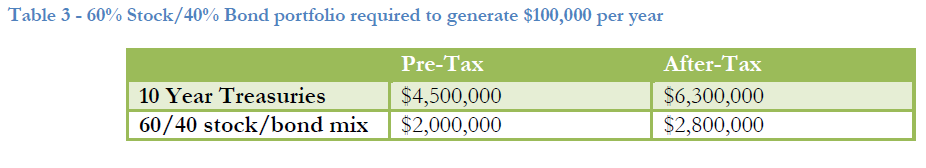

You would have to be living in a cave to be unaware that current yields1 are near historic lows. It requires more capital to generate current income now than before when rates were higher. 10 year Treasury Bonds currently yield just 2.2 percent. At that rate, it takes over $4.5 Million to produce $100,000 of income per year.

But wait, it’s worse than that! The $100,000 of interest is taxable at one’s highest marginal tax rate. In a 28% Federal Tax Bracket, ignoring State Income taxes for the moment, it takes just about $6.3 million to generate enough interest ($138,888) to end up with $100,000 after tax.

Conclusion #2 – Rates are too low to expect to generate a significant amount of income from all but the largest portfolios.

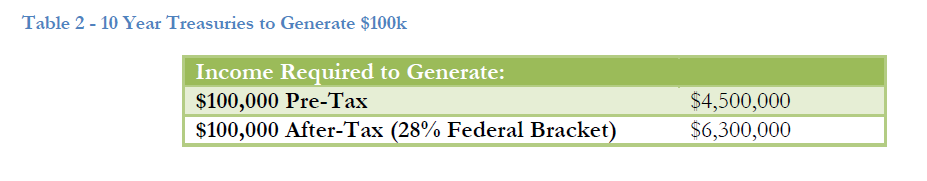

We believe a better way to create income from an investment portfolio is to put two trends to work for you: the lower tax rates on dividends combined with the growth that is expected from owning some amount of common stocks. The returns from stocks are so variable in the short term that it can be easy to lose sight of how much income they have produced for investors over the decades. A 60%/40% mix of stocks and bonds can be assumed to deliver a 5% return over time.

Bringing Stocks into the mix means more risk, of course, in terms of how widely the returns can swing from year to year. Using a mix of stocks and bonds makes an enormous difference in how much savings it takes to fund an income. The table below compares how much money it takes to produce $100,000 per year using all Treasuries versus a 60/40 mix of stocks and bonds.

Conclusion #3 – Ironically, adding risk can lower the amount of your savings goal

There are many things to consider when structuring an investment mix for total return to deliver income over a lifetime. Taxes and return are two of the important factors. Age, experience and risk tolerance are also important. Investment results are never guaranteed. Not much in life is, when you think about it. We work with clients to fine-tune the mix that will provide not only the result that is needed but also a good experience.

Please call or email us if you have any questions.

1 Current 10 Year Treasury Yields as of March 28, 2012. Source Bankrate