This is the time of year when families have occasions to gather together and enjoy each other’s company. The holidays can provide a good opportunity for parents and their adult children to start a conversation about finances. Many people are uncomfortable talking about money, and avoid discussing the topic. While taking about finances might not be the perfect holiday meal table talk, it is an important topic, and open conversations can bring peace of mind to parents and their children.

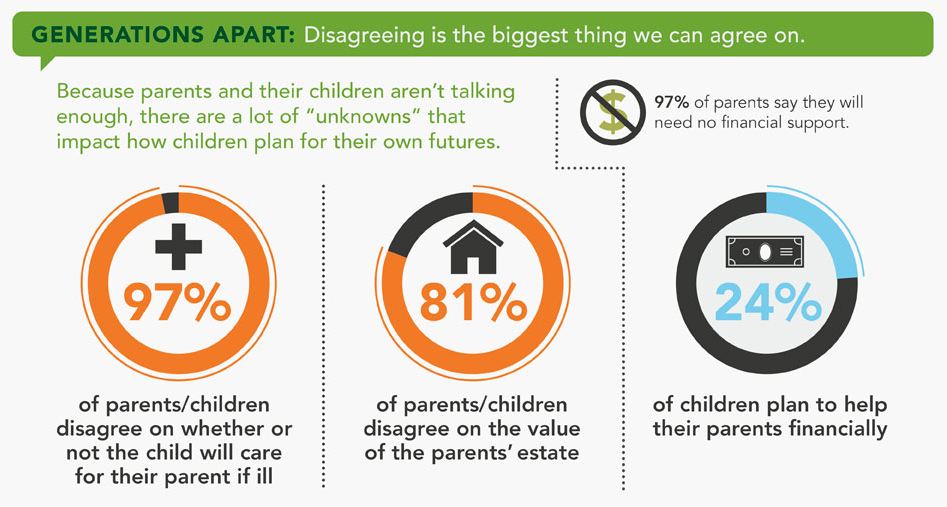

A recent Intra-Family Generations Finance Study by Fidelity Investments® highlights the fact that most families fail to have meaningful financial conversations, even though 9 out of 10 agreed having those financial discussions is important. Lack of communication can lead to large disconnects between parents and their adult children about expectations for retirement, elderly care, estate, and inheritance strategies. This disconnect is very apparent when viewing the results of the study that included parents (55+) and their children (30+).

Full image/disclosure: Fidelity Investments

Nearly all parents included in the survey (97%) said they would not need any financial support in retirement, while almost a quarter of children (24%) plan to help support their parents.

Another major disconnect was regarding whether a child would care for his or her parent if the parent became ill – with nearly all (97%) of the parents and children disagreeing. The number one word adult children used to describe their own retirement was “anxious” and unknown expectations about their parents’ financial situations plays into that anxiety. Parents and children who have engaged in detailed financial discussions reported increased peace of mind.

So what is keeping your family from having important financial conversations? If you’re like the respondents to the survey, parents feel that the #1 barrier to open communications is not wanting their children to rely too heavily on an inheritance. The #1 barrier reported by children is the feeling that their parents’ financial situation in none of their business.

We’d like to encourage this important dialogue in all families. Both parents (68%) and children (60%) reported they feel more comfortable having financial conversations in the presence of a professional advisor than without.

We can provide a safe and structured environment for a first discussion. We also know many competent professionals we can call upon to implement the next steps. Our network includes estate attorneys, accountants and even specialists in Family Foundations. We invite the families in our sphere to engage one in a meeting designed to remove barriers, spark communications, and ensure that important financial topics are discussed in meaningful detail. The longest journey begins with a single step. Let us help with that first step.

Please email or call us if you have any questions or concerns.