Soon you might have a chance to buy stock in one of the most impressive growth stories of all time as Facebook is expected to become a publicly traded company on Friday, May 18th. At the range of prices anticipated, founder Mark Zuckerberg becomes the latest uber billionaire. And in a case that should be discussed in business schools for years to come, private equity firm Accel Partners could turn a $12 million investment into a profit of over $7 billion. Who wouldn’t want to get in on this kind of gain? By the way, the seeds of that gain were planted in 2005. Our guess is most investors hadn’t heard of Facebook back then.

Surely the founders of Facebook and the hordes of technologists and executives who have built this company are one smart bunch of people. And their timing was good with social networking which has a component of luck to it. So now these smart, lucky people are selling. When you buy, you buy from them. Are you sure you want to do that?

We don’t mean to be all about buzz kill. Properly done, investing is a boring proposition. Get the allocation right, manage costs and taxes, rebalance to take advantage of market fluctuation, blah, blah, blah. Where’s the fun in that? Well, actually, we don’t suggest you look to your serious investment money for fun or entertainment. It is much more reliable to seek fun and enjoyment in travel, hobbies, family and friends.

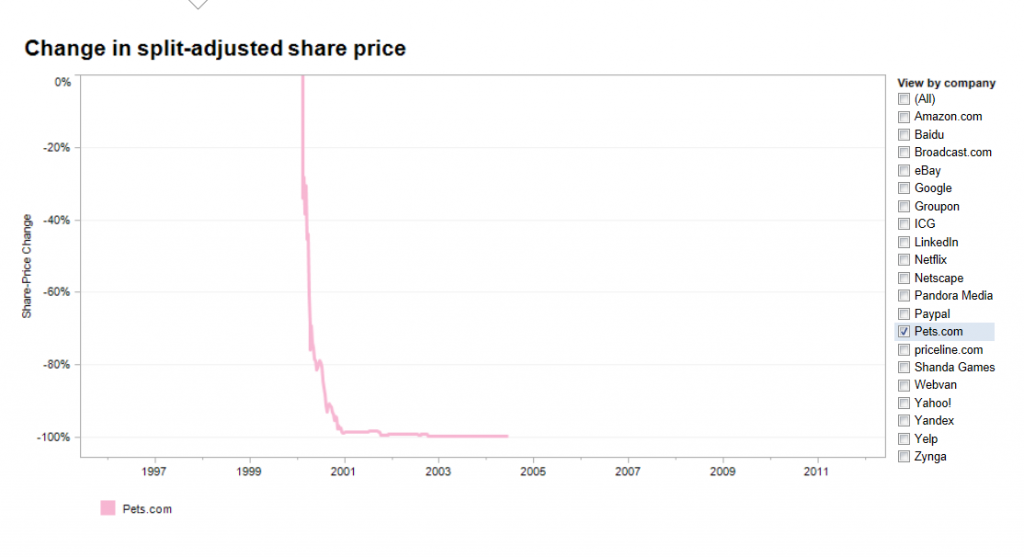

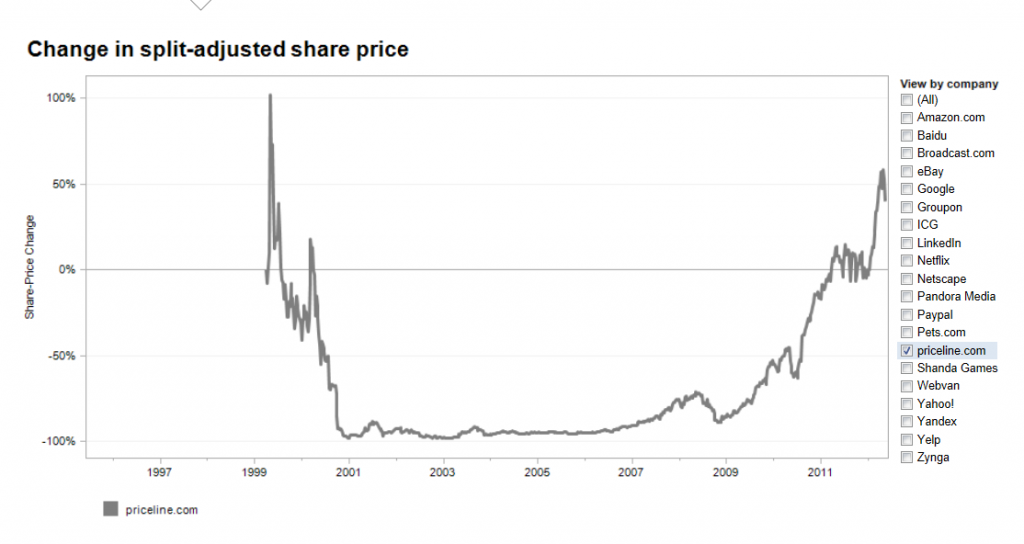

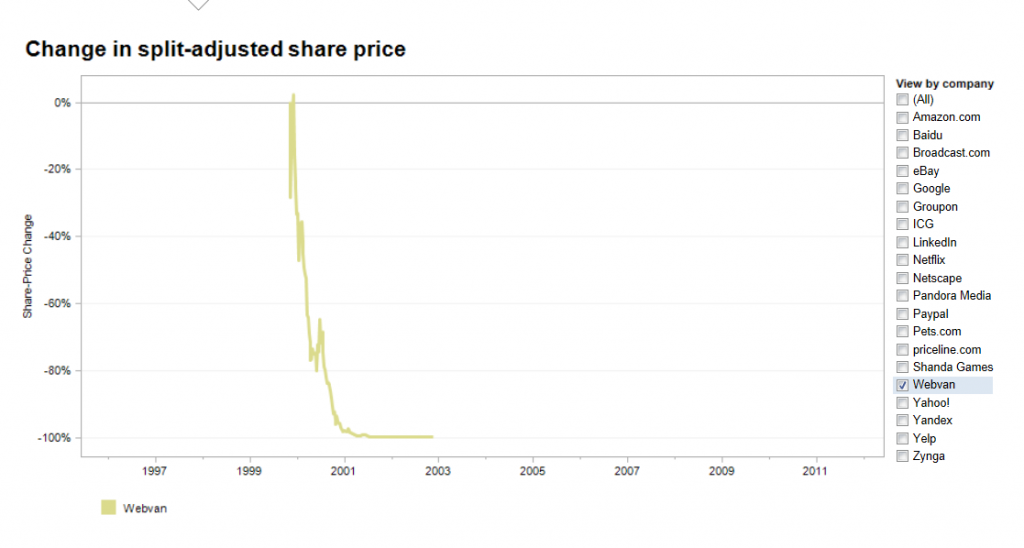

But, on the other hand, if we’re not talking about serious money, then we say go ahead, have a little fun. Add a small position in a stock or two that you’d like to follow. It will provide a great benchmark over time when measured against your serious money investments. We even created a word for this – “specutainment”. Those who have made a small fortune on Apple stock in recent years might have also invested in Webvan, which went to zero in 2001.

So much has been written about this highly anticipated IPO that it’s hard to add anything of value. Should the shares go public in the mid to high $30 range per share, the company will have a value of over $100 Billion. According to the Wall Street Journal, Facebook earned $1 Billion last year, so we’re looking at a Price to Earnings (P/E) ratio of 100 or so. By any comparison that is a very high valuation so buyers beware you are not getting it cheap. We wouldn’t be surprised to see the shares double or more from the IPO price during the first few seconds of trading. Most regular investors will be buying at those higher prices.

The brokerage firms participating in the stock offering will allocate shares to their very best customers [mostly institutions like pension funds, mutual funds etc.]. It’s a pretty good way to keep those customers coming back for more IPOs – many of which don’t stay above their offering price very long.

To be clear, we have no way of getting in on the IPO of Facebook at the initial price. Schwab doesn’t participate. As soon as shares are traded, we will be able to buy your specutainment shares, if you like, at whatever price they are selling for [or any limit we decide to set].

We promise not to overdo the buzz kill as long as you don’t overdo the specutainment. If you’d like a little Facebook in one of your accounts and if it makes the entire investment process more fun and interesting, you have our blessing.

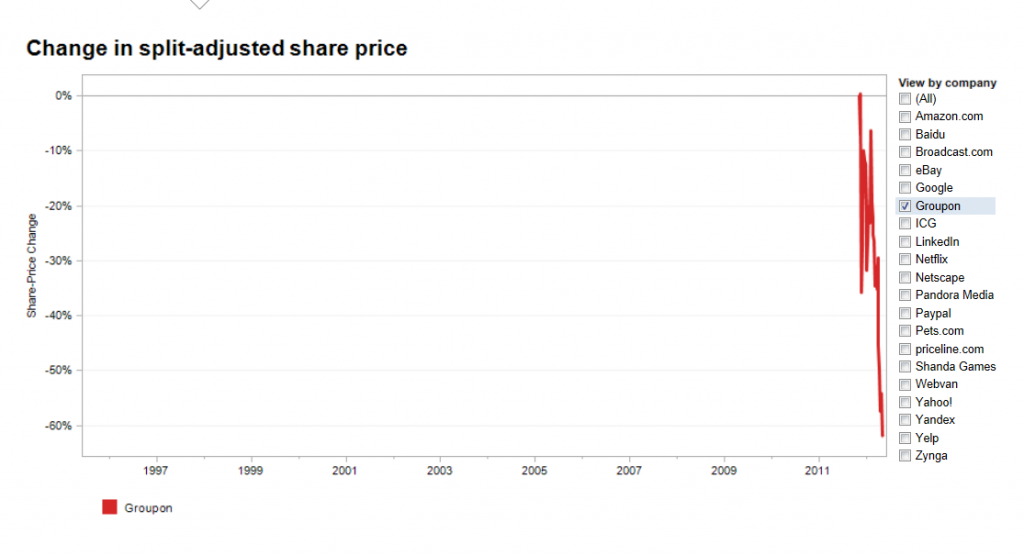

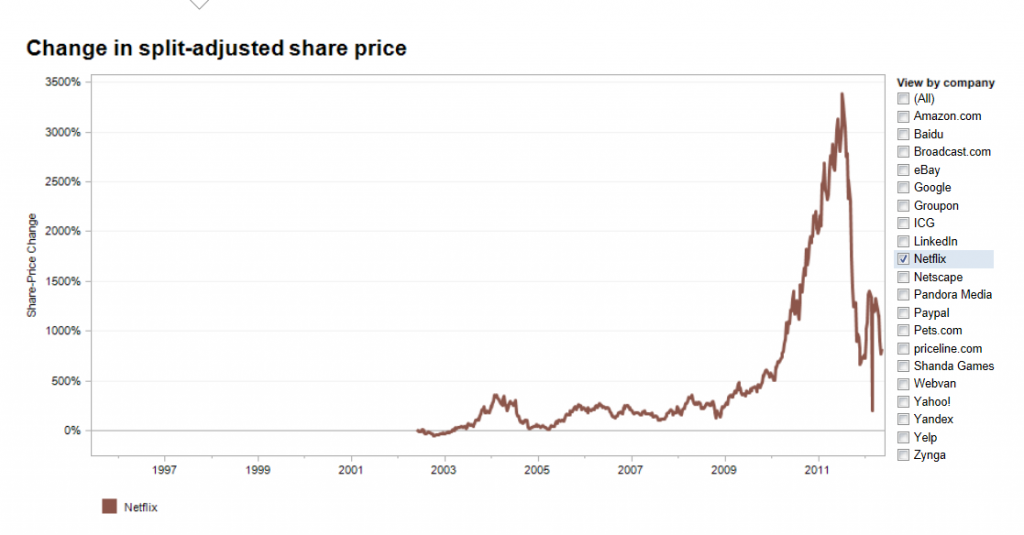

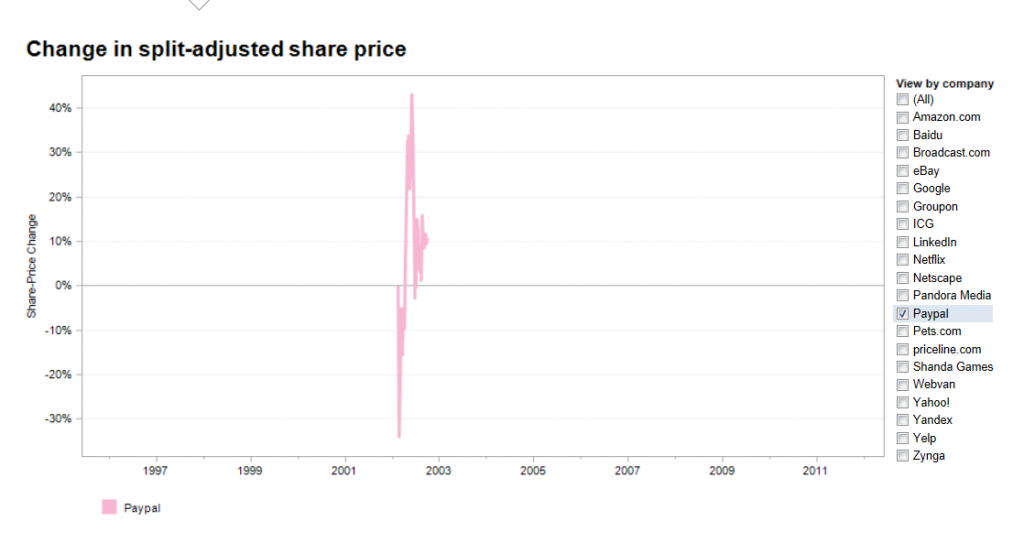

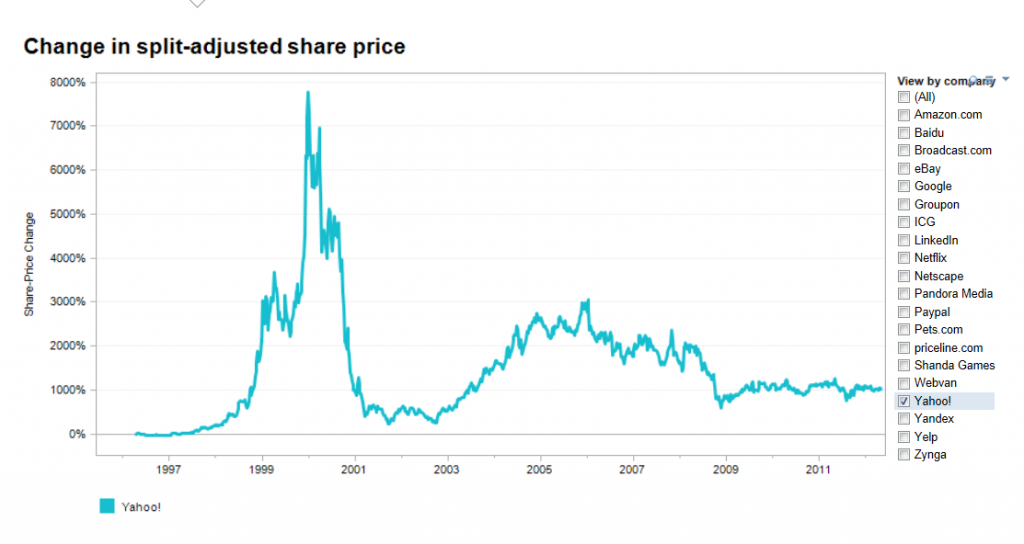

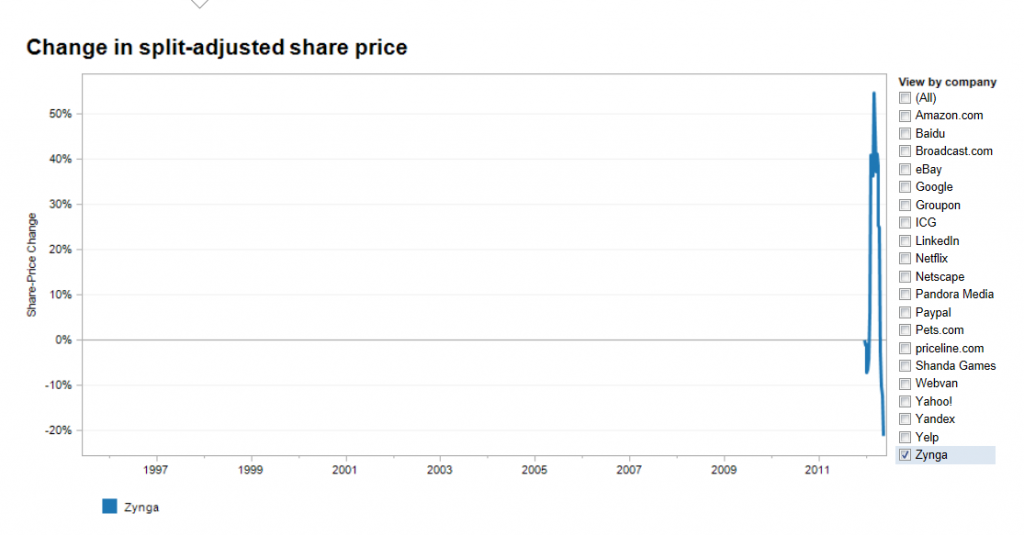

In case you haven’t read enough about it, here’s a link to an interesting article from CNN.com. Also of interest is an interactive graphic from the Wall Street Journal that provide data on 20 recent large technology related IPOs just so you can remember Webvan and Pets.com as you salivate over the Google returns. Also, notice the fluctuations in price. Investing in initial offerings is not for the faint-hearted. Enjoy!