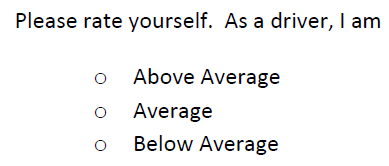

Did you predict the outcome of the Superbowl? When you have a strong opinion, how confident are you that you have your facts right? What about the other party in the conversation. Do they feel the same way? Before we introduce the topic of this month’s article, we’d like to ask you to take a one question survey:

The question is one asked every year by Terrance Odean of his MBA students at Berkeley’s Haas School of Business. With remarkable consistency, his students generally rank themselves as 80% above average, 20% average and almost no one ranking themselves as below average.

What is going on here? Are 100% of MBA students really that competent behind the wheel? That’s one possible explanation. But Professor Odean has another theory, backed up by years of rigorous investigation of the investing habits of millions of brokerage statement that show clearly what people did with their money, not just what they remembered or said.

What the professor found was the overconfidence bias. Don’t confuse that with optimism or pessimism. What we are talking about here is the belief that one’s opinion is more likely to be right than it is. This is very easily measured in a brokerage account. People buy and sell in an attempt to make a profit. After a transaction, it is possible to observe the performance of what was sold or bought in order to know whether buying or selling was a good idea. If an investor had skill, we would expect to see them sell stocks before they lost value and to make purchases before they gained value.

In fact, the opposite was true. In study after study, investors sold what turned out to be winners, hung on too long to losers and cost themselves money from a variety of behavior biases, among which was overconfidence. Dr. Odean observed that men were noticeably more confident in their investing and that they traded more often, with worse results than women.1 Interestingly, the results held through a variety of large samples, from a group of 35,000 US brokerage accounts that he was allowed to anonymously evaluate to one sample of 4.4 Million brokerage statements representing all the transactions done in one year in Taiwan!2

What did Professor Odean learn? On average, individual investors lose money from trading not just from extra transaction costs but from “perverse security selection abilities”. Translation: they buy stocks that earn subpar returns and sell stocks that earn strong returns (Odean 1999). The research firm, Dalbar, has repeated a similar annual study over the past two decades and concluded that investor behavior costs 3‐6% per year, dwarfing the actual costs associated with investing (commissions, research, advisory fees, etc. As we often point out, 95% of our mental activity is subconscious and driven by emotion and deep seated instincts. We often make decisions emotionally and then rationalize with intellect (confirmation bias). The dangerous fact is that Markets = Feelings. Is Facebook a good stock to buy? With over 800 million users (and growing) we have to recognize that it is becoming familiar at a pace that few things ever have. And familiarity is one of the factors associated with overconfidence. That is why company stock is over‐owned by employees when available in their 401k accounts. At WorldCom and Enron, employees lost 100% of the portions of their 401ks invested in their employers’ stock when those companies collapsed. Being that close to a company led to overconfidence in its performance.

Think back to the beginning of this article. How did you rate yourself? We’re guessing it was at least average (just like us)!

We cannot help but have expectations about what will result from any set of circumstances. Europe has a banking crisis, the oceans are warming, and the New England Patriots had a more experienced quarterback! Of course, tools and training and index funds can help to overcome biases like overconfidence. We are here to help to avoid what often turns out to be bad investment behavior. As you’ve heard from us before, we believe it is best to stick with our plan and avoid gut feelings that may reflect a bias of overconfidence. Investor behavior trumps investment performance.

1 Boys will Be Boys: Gender, Overconfidence, and Common Stock Investment by Brad M. Barber and Terrance Odean. 2001

2 The Cross Section of Speculator Skill – Evidence from Day Trading by Barber, Yi‐Tsung LOee, Yu‐Jane Liu and Odean, May 2011