Are we reducing deficits too quickly?

At the end of May, Tim and Dave attended the annual meeting of the Northern California Chapter of the Financial Planning Association (FPA). This two day meeting is widely regarded as one of highest quality meetings of its kind and we make a point of attending each year.

One of the most surprising takeaways was a keynote presentation by Stephanie Kelton, Ph.D., chair of the Department of Economics at the University of Missouri-Kansas City. Speaking to an audience of 500 professional financial advisors that consider themselves financially literate, she turned many heads with her position that too much austerity could cripple the economy. Yes, there is such a thing as reducing our deficits too quickly. Deficits matter, but not in the ways we likely think. After all, a dollar spent by government ends up somewhere in the private sector.

One of the most surprising takeaways was a keynote presentation by Stephanie Kelton, Ph.D., chair of the Department of Economics at the University of Missouri-Kansas City. Speaking to an audience of 500 professional financial advisors that consider themselves financially literate, she turned many heads with her position that too much austerity could cripple the economy. Yes, there is such a thing as reducing our deficits too quickly. Deficits matter, but not in the ways we likely think. After all, a dollar spent by government ends up somewhere in the private sector.

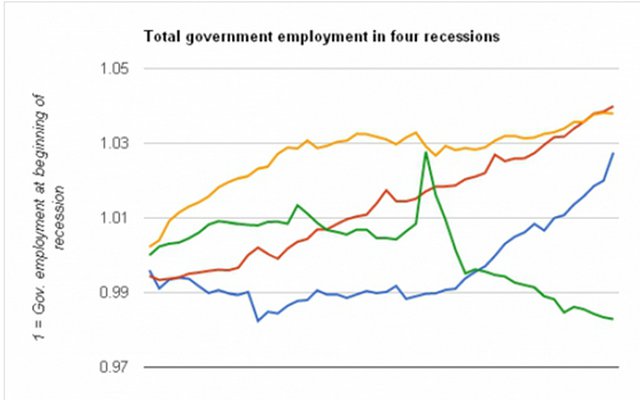

Categorizing herself as a “Deficit Owl”, she introduced the idea of Modern Monetary Theory (MMT) in which she convincingly made the point that it is a fallacy to think of the US Government’s finances in the same way we think of a household budget. Unlike an individual who eventually goes bankrupt if they continue to overspend, the US Government has the ability to create more currency since in 1971 we went off the gold standard. MMT suggests that Government deficits and surpluses should be used to encourage full employment. This is in fact exactly what the Federal Government has done during past recessions prior to 2008.

Deficit “Hawks” advocate for government austerity in order to reduce deficits and pay down debt. In the past three years the deficit has fallen faster than in any stretch since the demobilization from World War II according to the Office of Management and Budget (OMB). Professor Kelton points out that running surpluses and aggressively paying down debt has not worked out well in the past for the government. The 7 periods since 1776 where government ran surpluses and paid down debt coincided with 6 depressions and eventually the Great Recession of 2007-2009.

Deficit “Hawks” advocate for government austerity in order to reduce deficits and pay down debt. In the past three years the deficit has fallen faster than in any stretch since the demobilization from World War II according to the Office of Management and Budget (OMB). Professor Kelton points out that running surpluses and aggressively paying down debt has not worked out well in the past for the government. The 7 periods since 1776 where government ran surpluses and paid down debt coincided with 6 depressions and eventually the Great Recession of 2007-2009.

As long as we can issue our own currency that is the reserve currency of the world, she explained that we cannot have the same problems as Greece, Italy or Spain who borrow in a currency (Euros) that they do not control. We won’t try to cover her two hour presentation here, but if you’d like to read more, the Washington Post did a thorough article on her research which you can read – just Google “Now meet the deficit owls”.

We attended other sessions covering diverse topics as the latest thinking in portfolio thinking, how to maximize Social Security benefits, technology tips and behavioral economics. It was also a great chance to connect with colleagues. We were reminded of the value of occasionally having an open-ended conversation just to learn what’s on our colleagues’ minds. In that spirit, if you’d like to have an open-ended conversation about deficits or other topics, please give us a call at 415.925.1212.