This winter turned out to be milder and dryer than most expected. Similar to the difficulty in predicting weather, should we be concerned about possible surprises on the bond side of your investment portfolios?

Some clients have questioned whether now may be a bad time to own bonds. With interest rates at historically low levels and certain European governments seemingly on the edge of default, are bonds no longer an appropriate investment? The short answer is: not the way we invest in bonds.

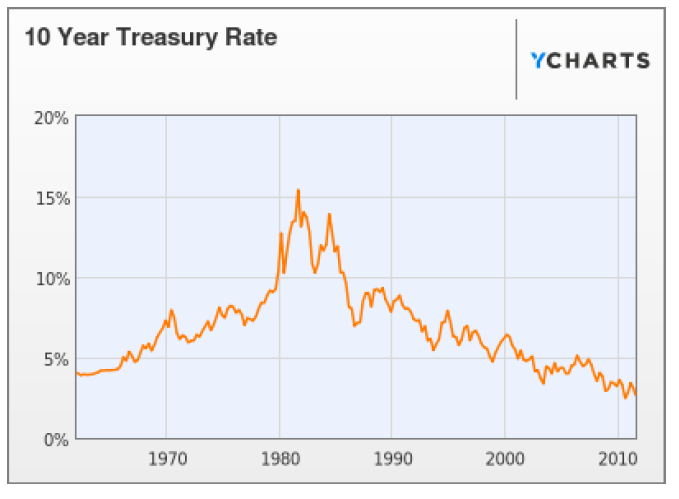

Source: Ycharts.com

It’s true that interest rates have fallen significantly over the last thirty years. Some of us recall when six month CDs paid 17% in 1981 and 10 year Treasuries yielded 15%. Today 10 year Treasuries yield 2% and six month CDs earn 0.53% 1. Interest rates don’t have much further to fall. What happens when they inevitably rise? Despite the Federal Reserve Bank’s pledge to keep rates low through 2014, with the increasing federal deficit it is likely just a matter of time before rates rise. Our strategy is described below.

Diversification, Short Duration and Quality

At MFA, we invest in bond funds that invest in large pools of bonds issued by governments and companies. The multiple bond holdings help diversify away the risk of an individual bond default becoming a significant event in your portfolio. Our holdings are primarily in short to intermediate term bond funds so we are less exposed to declines in value when interest rates rise. The average duration of the three bond funds where we have the largest allocations is less than four years.

Also, as bonds constantly mature in these pools, the fund managers replace them with new bonds. As rates rise, those new bonds will come with higher yields. The vast majority of the underlying bonds in our portfolios fall on the high end of quality spectrum: investment grade.

So, we continue to believe that bond funds offer a good buffer from the volatility of the stock market. In a rising rate environment, they may not offer the same level of total return we have enjoyed over the last few years but, they still provide the steady interest payments and lower volatility that should continue to help smooth out our investment performance. There are a lot of things to worry about in today’s world but, we don’t think the bond portion of our portfolios should be on the list.

Please call or email us if you would like to discuss further how we invest in bond funds.

1. http://www.federalreserve.gov/releases/h15/data.htm