Global currency is not something we normally spend a lot of time talking about. As a general rule, our international bond fund managers hedge their holdings against the changes in the value of their home currencies and the dollar. The stock funds that we use, on the other hand, are generally not hedged.

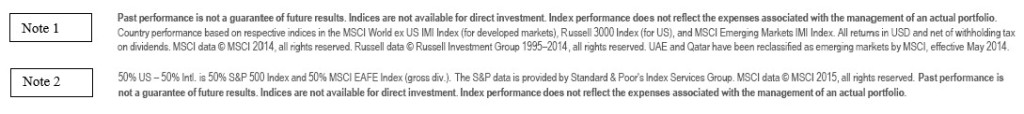

Global  currency trading, measured by daily dollar volume, far exceeds stock and bond trading combined. Price swings can be sudden, relatively large and quite unpredictable. As seen in the chart to the right, over time changes in currency pales in comparison to stock prices. For this reason and the added diversification from the currency, our policy is to choose stock funds that don’t hedge or guess future values of foreign currency versus the US Dollar.

currency trading, measured by daily dollar volume, far exceeds stock and bond trading combined. Price swings can be sudden, relatively large and quite unpredictable. As seen in the chart to the right, over time changes in currency pales in comparison to stock prices. For this reason and the added diversification from the currency, our policy is to choose stock funds that don’t hedge or guess future values of foreign currency versus the US Dollar.

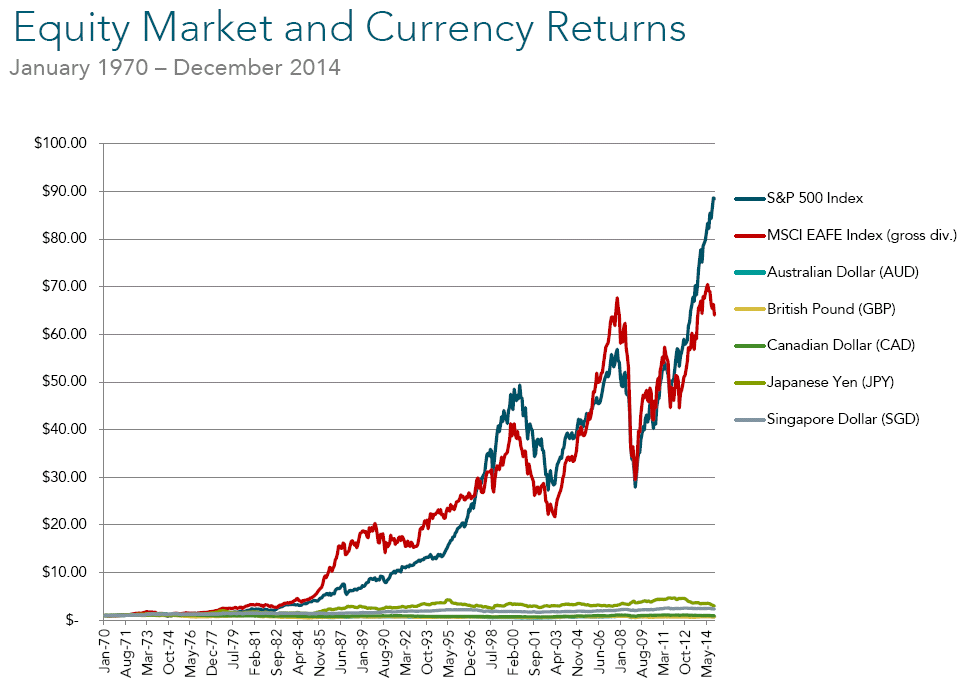

2014 was just one of the more extreme examples of currency fluctuations over the last fifteen years (1999-2014) as evidenced by the below Currency Return chart below.

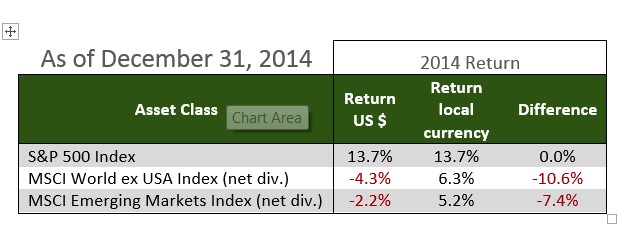

Since the dollar has been on a tear of late, it has acted as a headwind for US dollar based investors (like us) when we invest in non-dollar denominated stocks. While international developed and emerging market stocks performed reasonably well in their local currencies in 2014 (see chart above), when we convert back into the US dollars we invest in, both asset classes showed losses.

Just like stock market predictions or predictions of any kind, we believe trying to guess how currency rates are going to fluctuate is unwise. In 2006, it was an advantage to be diversified away from the dollar. Compare 2006 to 2014.

The “Average Total Return” for investing in global stocks over the last 15 years was 112.5%. The majority of our expected returns is derived from taking the risk associated with owning stocks not from betting on or against the dollar.

What about hedging? Hedging the dollar vs. foreign currencies would have smoothed out our results but ultimately, the cost to carry that hedge over the 15 years would detract from our cumulative returns.

The bottom line is that we purposely expose ourselves to the vagaries of currency fluctuations because research indicates that the cost to avoid it would not be justified and is likely to detract from our clients’ long term goals.

We would love to hear from you to review the risk, return and diversification of your investments or just to touch base on other topics of interest.