What’s Been Happening?

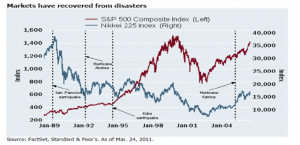

The natural disaster in Japan and resulting issues with nuclear plants in the area have been generating headlines since mid March. While incredibly devastating for the residents effected, it appears that the impact on the global economy from these events is somewhat muted. Despite being the world’s third largest economy, Japan represents only about 9% of global gross domestic product [GDP]. As the nearby chart displays, it is typically unproductive to sell following natural disasters. Despite a stock market pullback following the tsunami and subsequent events, the international stock funds we use [which include Japan] finished the first quarter up over 4%. Events in the Middle East and Libya in particular are troubling, but our view is that the perception of these events is priced into markets. We will make adjustments (rebalance) based on what has happened, not on what we think might occur.

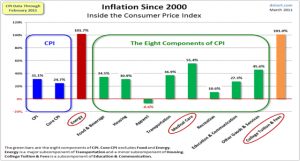

While the Core Inflationfigure that is most widely reported continues to hover around 2%per annum, we realize that energy and college costs have doubled in the last ten years. Those two real world expenses are not included in the Core CPI (See chart at left). The long term average for inflation is 3%. With the large overhang of government debt and the improvement in economies globally, we feel it is prudent to be positioned to withstand the detrimental effects inflation has on our purchasing power. That is why we hold Treasury Inflation Protected Securities [TIPs – essentially safe government bonds with a yield tied to the rate of inflation] and stocks. Researchers at the University of Chicago found that since 1926 the US stock market outpaced inflation by just over 6% per year on average1.

1. Real return calculation: (1+CRSP 1-10 Index return)/(1 + US CPI)-1. The CRSP 1-10 Index is a market capitalization weighted index of all stocks listed on the NYSE, Amex, NASDAQ, and NYSE Arca stock exchanges. CRSP data provided by the Center for Research in Security Prices, University of Chicago.

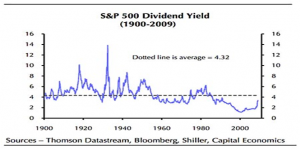

Yields from money market and short term CDs are close to zero. Dividends from the stocks funds we own clock in at 1.25% to 2.5%. While historically on the low end of their range, your dividends can be easily missed in the 10% to 20% total returns over the last twelve months. Further comfort can be taken from our bond fund mixes which returned about 4% for the year ended March 31, 2010.

Other Trends To Be Aware Of

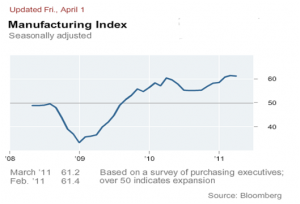

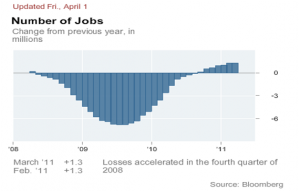

To offset some of the negative news we hear daily here are a couple of charts showing some positive developments. Manufacturing has improved significantly over the last two years and continues to expand. While still high, unemployment at 8.8% continues to move in the right direction and new jobs are now being created at a rate in excess of population growth.

As you know, in Washington there is much discussion and disagreement about how to handle the federal budget deficit. Resolution and implementation of measures to at least partially address the expected future yawning deficit should be welcomed by both the bond and stock markets. We are less concerned about local and state municipal financesand believe that these entities which nearly universally must arrive at annual balanced budgets will resolve their shortfalls. Also, the percentage of state and local government outlays to service and repay debt is much lower than that of the federal government at about 4% – 5% of their total budget. We are not ignoring the fact that states and local governments have significant long term pension obligations, but we see many municipalities addressing this issue mainly through the introduction of 401(k) type retirement plans in lieu of tradition pension plans. Much of the current budget concerns are a result of the recent recession pushing tax revenues lower [down approx. 11%] and forcing more spending than planned. As the economy continues to improve, tax revenues will increase and spending in areas such as social services should fall as the number of unemployed continues to be reduced. Unfortunately, there appears to be a repeating cycle of “feast and famine” in government budgeting.