What’s Been Happening?

The old Chinese curse, “May you live in interesting times”, appeared to be in full force in the fourth quarter of 2008. The market stampede away from assets with any risk to the safety of US Treasury bonds continued and accelerated in the fourth quarter. As a result, any investment that was not US Treasury guaranteed suffered. Stocks, corporate and municipal bonds and alternative investments were all battered. For example, the S&P 500 stock index, twice during the past quarter, lost more than 20% of its value with a partial recovery in between.

Fundamentals didn’t matter throughout 2008 and especially in the fourth quarter. While barely noticed, since its November 20th low, the S&P 500 appreciated 20% by year end.

Trends to be Aware of

Recessions are normal contractions in the economic cycle. Since 1929 the US economy has experienced 13 recessions. While they don’t occur on a regular schedule, based on history, we on average should expect one to occur roughly every six years. The last recession began in March of 2001, so the current recession could be characterized as a bit overdue.

While in terms of timing, the recession was widely expected, its extreme severity was not. We won’t pretend to predict the length of the pullback but rather prefer to point out that in all modern recessions, the stock market has bottomed out about half way through the recession. So, if history is a guide, we won’t have to wait until the end of this recession to see the market recovery begin. Having said that, we would not be surprised to see several pullbacks as the market attempts to find a bottom. Our review of historical severe market downturns shows a pattern of several troughs followed by false summits before the long term positive trend reasserts itself.

The general consensus seems to be that the market will be in for some rough sledding as far as the eye can see. In our experience, the consensus is frequently wrong. Just a year ago, the surveys of prominent market analysts developed a consensus that the first half of 2008 would be tough and then market conditions would improve. Of course, that prediction was slightly off.

Deflation is the big worry now as the economy continues to naturally de-lever during this period of economic contraction. While a short term concern, we believe the bigger risk to investors down the road is the potential inflation caused by the significant stimulus measures taken by the Federal Government. The massive liquidity being added to the system, which appears to be having little effect now, could be priming the pump to rev the economy two to three years out. We are reminded of the image of trying to turn an ocean liner on a dime.

As counterintuitive as it may seem, at this point with market averages depressed as they are, expected returns are higher. From its peak in October 2007 to the trough in November 2008, the S&P 500 lost 54% of its value. We believe the market is unusually undervalued and will reward those who stay invested. That’s not to say that unemployment will not get worse, more bankruptcies won’t occur or the US consumer won’t continue to be stressed – we fully expect these trends to persist. But remember, the stock market anticipates future cash flows and corporate profitability and therefore will change direction well before the economy does.

Mortgage rates have been falling as a result of the Fed’s general easing of rates. With 30 year fixed rates at about 5% and 15 year fixed closing in on 4.5%, now is a good time to review the terms of your mortgage. We would encourage you to dig out your existing mortgage paperwork and would be happy to help you decide if it makes sense to consider refinancing while rates are hovering at historic lows.

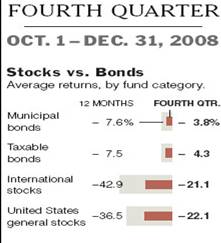

Some Numbers for Comparison:

The following table compares some key indices against which fund performance is measured. All figures are for the periods ending 12/31/2008.

|

Index |

What it Measures |

Last 3 Mos. |

Last 12 Months |

3 Years, Annlzd |

5 Years, Annlzd |

|

Standard & Poors 500 |

U S Stocks w/div |

-21.94% |

-37.00% |

-8.36% |

-2.19% |

|

Russell 2000 |

Small Stocks |

-26.12% |

-33.79% |

-8.29% |

-0.93% |

|

Morgan Stanley EAFE |

Foreign Stocks |

-19.95% |

-43.38% |

-7.35% |

1.66% |

|

MSCI Emerging Mkts |

Emerging Mkts |

-27.60% |

-53.33% |

-4.91% |

7.61% |

|

DJ World Stock Index |

Global Stocks |

-22.07% |

-41.31% |

-7.75% |

0.45% |

|

DJ Real Estate Tot Ret |

Real Estate |

-38.52% |

-40.07% |

-12.73% |

0.89% |

|

Barclays 1-5 yr Gov’t/Cr |

Bonds |

3.60% |

5.14% |

5.54% |

3.87% |

|

CPI * |

Inflation |

-2.91% |

1.14% |

2.58% |

2.88% |

Chart Data Source: Thomson Financial

* CPI information is not current for past month.