Moviegoers were treated to a harsh view of stock trading earlier this year in the blockbuster movie The Wolf of Wall Street. Leonardo DiCaprio played Jordan Belfort, the 1990’s mastermind of an illegal stock manipulation scheme that defrauded investors and ultimately landed him in prison. The depiction, although based on a true story, seems too wild to be true – Friday afternoon parties to celebrate the week’s “take” with hired strippers, enough drugs to stock a pharmacy and unlimited expense accounts. One compelling scene shows Belfort demonstrating for his salesforce the power of his Machiavellian phone script in which he speaks directly to the prospect’s greed, insecurity and fear of regret as the unsuspecting customer agrees to purchase a “can’t mis s” opportunity that will turn out to be worthless.

s” opportunity that will turn out to be worthless.

If you think that was too long ago to be relevant, think again. Fraud that plays on greed is alive and well, as reported on Bloomberg news in March of this year in an article titled Bugatti-Driving 26-Year-Old Tied to $3 Billion Stock Promotions1. In this case, the telephone has given way to the Internet. The SEC filed a civil complaint in which they alleged that John Babikian (eerily he has the same initials as Justin Belfort) used an email list called AwesomePennyStocks to tout a coal company’s stock while dumping his own shares. Sound familiar? In another case, the value of a prescription-drug distributor that AwesomePennyStocks promoted in 2012 ballooned by more than $700 million within two months. After the messages stopped, the shares collapsed. The camera shy Mr. Babikian reportedly remains a fugitive from justice. A visit to the website (http://www.awesomepennystocks.com) announces they are no longer open for business.

Like other “wolves” before him, Babikian lived a rich life with million dollar cars and luxury homes and then, suddenly, became invisible. The SEC is now freezing his assets.

How can this happen you might ask? For starters, promoting stocks is not only legal, it’s a major source of revenue for Wall Street’s largest banks and brokers who recommend investment in stocks, often in companies they are advising. Business-themed cable channels host guests who tell us “what they like now” or “what to avoid”. It is illegal to manipulate markets and those offering investment advice on a security are required to disclose if they hold positions in the securities on which they offer advice. We call this “talking up one’s book”. They want you to buy the stock they already own. Just don’t expect to get a call from them before they decide to dump their shares.

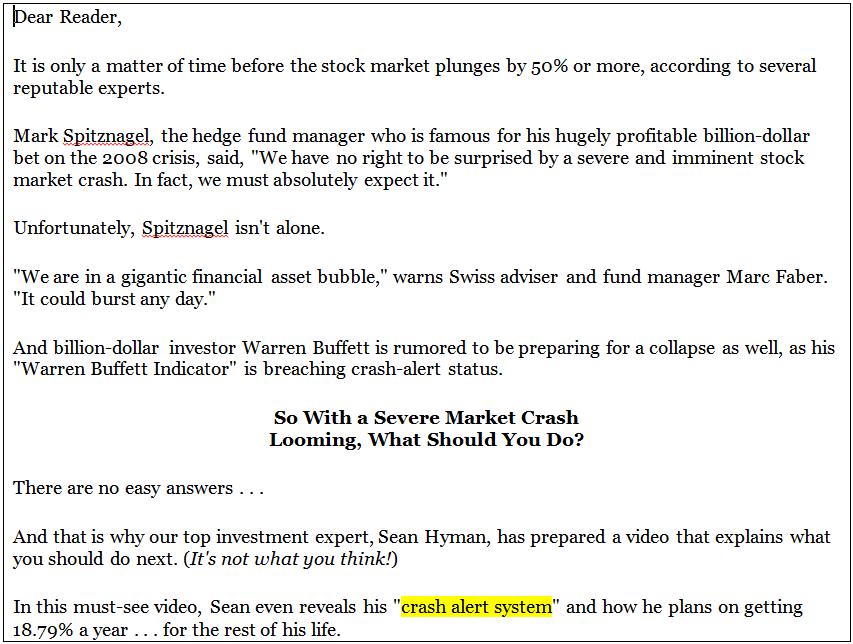

Fear is a powerful motivator. Here’s a message one client sent us, asking for our take:

At MFA we think the best evidence points to the premise that market prices efficiently price in all known information. There are two important questions to ask the next time you get such an offer:

What is their evidence? What are they selling?

As former Fidelity Magellan manager Peter Lynch once said, “Far more money has been lost by investors in preparing for corrections or anticipating corrections than has been lost in the corrections themselves.”

We always look forward to discussing your investments or touching base on other topics that affect your financial well-being.

1 Bloomberg Online, By Zeke Faux – March 21, 2014