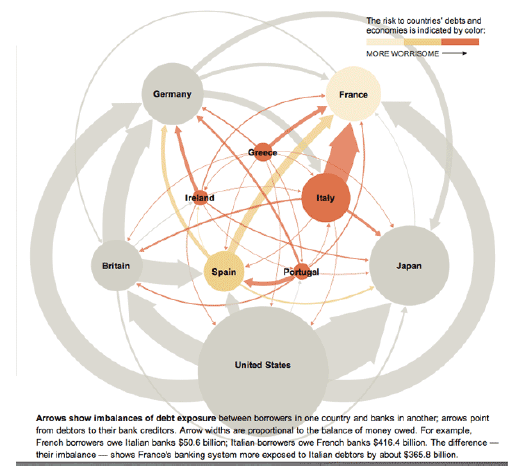

Should we be worried about the problems in the European Union [EU]? A certain amount of concern about government debt issues in Europe is well placed. Previously, government defaults were reserved for the emerging markets in places like Argentina and Russia. Just five years ago, the idea that Italy [gross government debt to GDP of 121%] Ireland [109%] or Portugal [106%] would be considered capable of default on their government bonds seemed far‐fetched science fiction. Now we grapple with frightening headlines from Greece [166%!] and the rest of the EU on a daily basis.

Marsh,

Marsh, Bill. (2011, 22 October) “It’s all connected: An overview of the Euro crisis” in nytimes.com Sunday Review. Other authors/designers listed include: Xaqun G. V., Alan McClean, Archie Tse, Seth Feaster, Nelson Schwartz, and Tom Kuntz.

Borrowing and spending too much money has put Greece in a position where it had to agree with its lenders to mark down and essentially forgive half of its debt.

With the interconnectivity of global capital markets and the interwoven working of the euro as a shared currency, it is possible the problems in Greece could spread to effect other countries such as Italy and beyond.

Last week Eurozone leaders cobbled together a plan to address the issue which was immediately welcomed by a rally in global stock markets on Thursday. While it appears that this is not the final or permanent solution, it did show resolve on the part of the stronger nation states of France and Germany to pursue a remedy averting a financial meltdown similar to 2008. Below is a diagram designed to illustrate the plan and its various options.

The Eurozone could continue to muddle through with voluntary write‐downs in Greek debt, increased capital requirements for banks, and most importantly, stronger support from the European Central Bank to backstop losses. It also seems very possible that the EU will walk away from Greece, allowing it to leave the euro and truly default on its debt.

There is concern that such an outcome, while potentially better for the Eurozone, could trigger a global markets reaction similar to the meltdown following the default by Lehman Brothers in 2008.

No one ever knows for sure what will happen, so our advice remains consistent. An asset allocation with the appropriate mix of global stocks, bonds and alternative investments should allow us to ride out the continued volatility expected until there is a more permanent solution. This approach worked well for investors who held on when it appeared that the global financial system was unraveling in 1929 and 2008. It is worth remembering that in less than three years the Dow Jones Industrial Average regained about 85% of the loss to stand at around 12,000 as we write this.

We encourage clients to keep us updated on any changing circumstances and to contact us if they would like to review their asset mix.