Usually we write our own newsletters but we received the following well written article from American Funds about market volatility

and wanted to share it with you.

What Past Market Declines Can Teach Us

Stock market declines are the last thing most investors want to experience, but they are an inevitable

part of investing. Perhaps a little historical background can help you put stock market declines in

perspective.

Types of Stock Market Declines

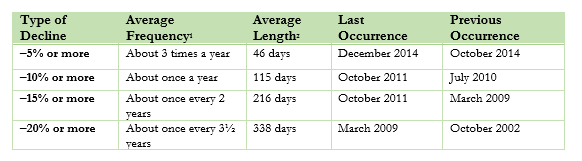

A look back at stock market history since 1900 shows that declines have varied widely in intensity,

length and frequency. In the midst of a decline, it’s been nearly impossible to tell the difference

between a slight dip and a more prolonged correction.

The table below* shows that declines in the Dow Jones Industrial Average have been somewhat regular events.

Lessons Learned From Market Declines

Living with a market decline isn’t easy, but if you understand these 3 key lessons, you’ll be a more intelligent investor.

- No one can predict consistently when market declines will happen.

It’s easy to look back today and say with hindsight that the stock market was overvalued at a particular time and due for a decline. But no one has been able to accurately predict market declines on a consistent basis.

In January 1973, a New York Times poll of 8 market authorities predicted that the market would “move somewhat higher” in the future. The Dow industrials proceeded to decline 45% over the next 23 months. Then, although almost no one predicted it, the Dow rose 38% in 1975.

- No one can predict how long a decline will last.

Since 1982, with few exceptions, market declines have been relatively brief. Earlier market declines have lasted longer.

After the 1929 crash, it took investors 16 years to restore their investments if they invested at the market high. In 2000, it took about 5 years. But after the 1987 crash, it took about 23 months to get back. In 1990, it took about 8 months. (In all cases, dividends were assumed to be reinvested.)

- No one can consistently predict the right time to get in or out of the market.

Successful market timing during a decline is extremely difficult because it requires a pair of near-perfect actions: getting out and then getting back in at the right time.

A common mistake investors make is to lose patience and sell at or near the bottom of a downturn. But even if you have decent timing and get out early in a decline, you still have to figure out when to get back in.

A bear market is not usually characterized by a straight-line decline in stock prices. Instead, the market’s downward trend is likely to be jagged – showing bursts of stock price increases, known as “sucker’s rallies,” and then declines.

Feel free to contact us to further discuss this or other topics.

______________________________________________________________________________________________________

*Source: Capital Research and Management Company

1Assumes 50% recovery rate of lost value.

2Measures market high to market low.