Every decade or so, it seems there is a new investment theme that is promoted as the greatest, “must have” idea in one’s portfolio. Research will have “shown” that had you invested this way over some prior period, your results would have vastly outpaced a simple patient buy and hold strategy that captures the returns of the capital markets.

It’s all about one of two opposing emotions, Fear and Greed, and the new offer will either bestow superior returns or “would have” avoided whatever nasty downturn recently occurred. We have been around long enough to see some trends appear and we now enjoy the perspective of seeing if the initial hype was justified. Usually we see how the Survivorship Bias1 twists the truth.

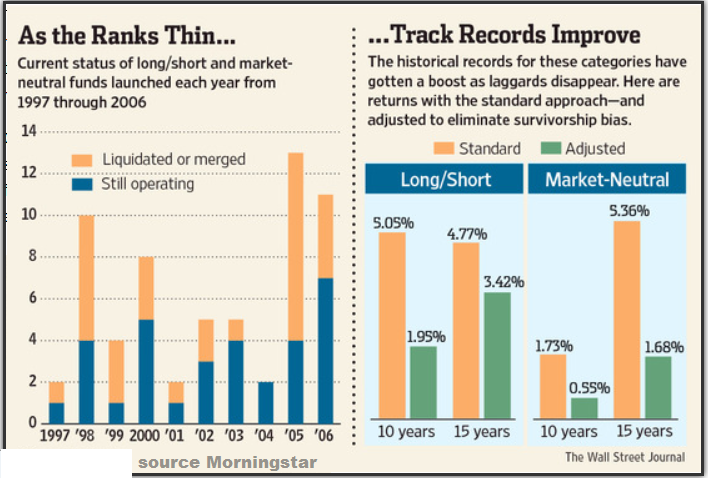

Karen Damato’s recent Wall Street Journal article outlined how history has largely been written by the winners. You can read it here. Ms. Damato reviewed the history of two categories of Mutual Funds that were broadly introduced and promoted 10-15 years ago.

Known as Market Neutral and Long/Short, these were not your plain vanilla funds. Prior to that, these investment styles were available only to institutions such as pension funds, university endowments and elite family offices such as that established for the Rockefeller family. Market Neutral and Long/Short strategies both offer the possibility of reducing risk and offering positive returns regardless of the broader market direction.

Long/Short funds allow mutual fund managers the ability to buy stocks when they are bullish on the market’s prospects and to sell borrowed stocks (shorting) to benefit when they think stocks will decline. Market Neutral funds were designed to combine multiple investment strategies in one package with the prospect of low risk positive returns.

The older we get, the better we were. So how has that worked out? Well, the record is mixed but with a disturbing pattern. Some of the funds launched from 1997 – 2006 have survived but many have not. Those that disappeared (presumably due to poor performance) took their poor records with them. The result is that the track record for thcategory overstates how the funds did. When Morningstar adjusts its figures for the 10-year and 15-year records for the long/short and market-neutral categories to eliminate this Survivorship Bias1, all four numbers drop. (The modified calculation includes for each month all the funds operating in that month.) Using numbers through July 31, the 15-year return for market-neutral funds falls significantly to an average of 1.68% a year from 5.36%.

The Bad Die Young. In most years, the funds that have since disappeared performed worse than the survivors. Back in 2003 the average long/short fund gained only 8.5%, but current long/short funds that were around in that year gained an average of 19.2% that year. This doesn’t mean track records aren’t meaningful. Rather, they should be taken with a grain of salt especially when they pertain to a group of newer, quirkier or less mainstream funds that might be more affected by survivorship bias.

What’s on the Radar Today? We hear of some approaches (with appealing names like “Golden Cross) that tout trend following – making trades based on moving averages. No matter how cleverly conceived or how well an idea backtests, it is unlikely it will upset the basic laws of capitalism. Returns are highest when capital is scarce. This is another way of saying that buying low (when no one wants to) is the best way to make money. Risk and return are related – there is no such thing as a free lunch.

Is there a topic you would like to see covered in one of our newsletters? Send us your thoughts to advice@marinfa.com

1 Definition of ‘Survivorship Bias’

The tendency for mutual funds with poor performance to be dropped by mutual fund companies, generally because of poor results or low asset accumulation. This phenomenon, which is widespread in the fund industry, results in an overestimation of the past returns of mutual funds.

http://www.investopedia.com/terms/s/survivorshipbias.asp#ixzz258tzyco1