“The implication is that people in the mutual fund world, if they were any good, would be running hedge funds. That’s complete nonsense. Just because you’re greedy, it doesn’t make you smart.”

John Osterweiss, investment company founder, CEO and former long/short Hedge Fund Manger

No matter how much the economy, housing markets, banking industry and other objective measures of broad financial health continue to improve; it’s never hard to find a fresh source of financial angst. The Financial Crisis of 2008-09 turned out to be an ideal breeding ground for any matter of “alternative” investment products. Within alternative investments hedge funds have really taken off, with assets under management growing to a record $2.35 trillion by the end of June 2014 from $488 billion in 2000[1].

This exploding industry includes complex, expensive and illiquid investment strategies offering the alluring promise of better downside protection to jittery investors. Given the high fees of hedge funds, the median fee structure, is a 1.5% management fee plus a 20% incentive fee[2]. This means hedge fund managers are paid 20% of all returns above their target benchmark. It is worth asking whether investors are getting their money’s worth.

Numerous indexes and databases measure hedge fund returns, but they are subject to two main biases “survivorship” and “backfill.” Both biases arise from the fact that hedge funds are not required to report their returns to a regulatory agency. Reporting is on a voluntary basis by fund managers.

- Lack of required reporting makes determining real returns difficult but academics have tried and here are some of the results.

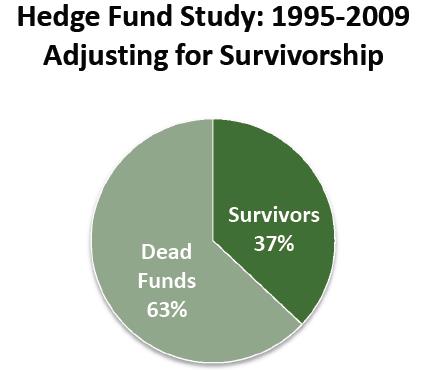

Survivorship: From 1995-2009, only about 1/3 of the hedge funds survived. The returns for the overall industry look much better when the hedge funds that went to zero are eliminated from the reporting.

Survivorship: From 1995-2009, only about 1/3 of the hedge funds survived. The returns for the overall industry look much better when the hedge funds that went to zero are eliminated from the reporting.

Backfill refers to the fact that many hedge funds include previously unreported performance to data collectors when they first start reporting their returns. This can be equivalent to asking the manger how he/she felt they would have done over the last 10 years if they had been in business at that time and then reporting those as actual numbers.

So when we add back to the industry those hedge funds that failed and when we remove the self-reporting, the overall return drops from 14.9%[3] to 7.7%. During this same time period the S&P 500 retuned 8.04%…

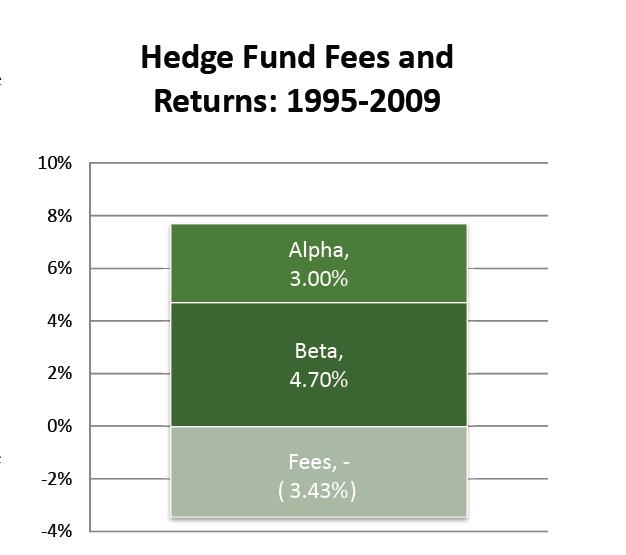

That 7.7% can be broken into excess returns generated by the manager and the general return anyone can get from the markets.

That 7.7% can be broken into excess returns generated by the manager and the general return anyone can get from the markets.

It turns out that about two thirds (4.7%) of the returns come from the markets and one third (3.0%) from the manager. However, manager fees are estimated to average 3.43%[4]. Bringing the Net excess return from the manager to -.43%

Two important claims that hedge funds tout:

1) They diversify your portfolio: In fact, as a group we find that these highly secretive hedge funds gain about 60% of their return from just being invested in the stock market. Thus, investors hoping to use hedge funds as diversifiers may be disappointed. Proving this point, in 2008, hedge fund returns were down as much as 20%, which was highly correlated with the stock market.

2) They can add excess returns: Yes, they can but on average they charge a fee that exceeds the excess return that they generate as a group. Hardly a sound economic transaction.

As always, we find it hard to profit from predictions and remain humble about our ability to forecast the future. However we will offer one fairly safe prediction: murky, over-priced investment packages will continue to benefit those who package and run them much more than the clients they convince to invest in them.

[1] www.barclayhedge.com

[2] Trading Advisor Selection System (TASS) Data base 1995-2009

[3] Trading Advisor Selection System (TASS) Data base 1995-2009

[4] “Are you getting your money’s worth, Sources of hedge fund returns” Dimensional Fund Advisors; 2013